All Categories

Featured

Table of Contents

This publication outlines the Infinite Banking Concept. To be sincere, I would have instead been on the beach than sat in the apartment paying attention to Dad read a financial book to us, however at the very same time, I was delighted since I saw that Dad was thrilled.

He was in practice long before I was birthed. However it got on that holiday, and especially the message in that publication, Becoming Your Own Lender, that changed the training course of our household's life forever. Right here's an intro to the Infinite Banking Principle and exactly how McFie Insurance coverage (previously Life Advantages) got going.

Nelson Nash, offered in the USA Flying force, worked as a forestry expert and later ended up being a life insurance policy agent and a genuine estate capitalist. To obtain cash for his property financial investments prior to the 1980s, Mr. Nash was accustomed to paying 9.5% accurate he borrowed.

Nash defined in his book. Soon, Father got on the phone informing household and pals concerning the Infinite Banking Concept. During the week, in his facility, he would certainly likewise tell his patients regarding the publication and share the concept with them too. A few months later on, he determined to get his life insurance policy manufacturer's license, so he can develop, market, and solution Whole Life insurance policy policies.

How do I qualify for Infinite Banking For Retirement?

But it had not been just Daddy's business. Mommy was working together with him, and also as young adults, we started aiding however we could. Prescription For Wealth is readily available as a complimentary electronic book or audiobook download. If you've looked into quite regarding the Infinite Financial Concept, there's a great chance you know my Father as Dr.

You might have even check out one of his books or seen one of his video clip discussions on YouTube. Actually, if you don't already have it, you can obtain his most preferred publication, Prescription for Wealth, as a free electronic download. The forward to Prescription for Riches was composed by Mr.

As the Infinite Banking Idea caught on, a growing number of individuals began to desire dividend-paying Whole Life insurance policy policies. Life insurance policy representatives around the country started to make note. Some agents enjoyed the idea, some representatives liked the idea of utilizing the idea as a sales system to offer more life insurance coverage.

To create a good plan that functions well for the Infinite Banking Concept, you have to minimize the base insurance coverage in the plan and raise the paid-up insurance policy biker. It's not tough to do, yet compensations are paid straight in regard to just how much base insurance is in the policy.

What type of insurance policies work best with Infinite Banking For Retirement?

Some representatives agree to reduce their commission to design a good plan for the customer, however several agents are not. Unfortunately, several life insurance policy agents told their customers that they were composing an "Infinite Banking Policy" however wound up writing them a bad Whole Life insurance policy policy, and even worse, some kind of Universal Life insurance policy policy, whether it was a Variable Universal Life insurance policy plan or an Indexed Universal Life insurance policy policy.

An additional danger to the principle came since some life insurance coverage agents began calling life insurance plans "financial institutions". This language captured the interest of some state regulators and constraints ensued. Things have altered over the last several years. The IBC is still about, and it still works. Mr. Nash's son-in-law, David Stearns, still runs the company Infinite Financial Concepts, which to name a few points, offers guide Becoming Your Own Banker.

IBC is often dubbed "boundless" due to its flexible and multifaceted strategy to personal money monitoring, particularly with the use of entire life insurance policy policies (Private banking strategies). This principle leverages the cash worth part of whole life insurance policy plans as a personal banking system.

What is the best way to integrate Infinite Banking Cash Flow into my retirement strategy?

This accessibility to funds, for any type of factor, without having to get approved for a funding in the traditional sense, is what makes the concept seem "unlimited" in its utility.: Utilizing policy financings to finance organization obligations, insurance, employee advantages, and even to inject funding right into partnerships, joint ventures, or as an employer, showcases the flexibility and unlimited capacity of the IBC.

As always, make use of discernment and hearken this suggestions from Abraham Lincoln. If you want unlimited banking life insurance policy and are in the market to obtain an excellent policy, I'm biased, but I advise our household's business, McFie Insurance. Not only have we specialized in setting up excellent plans for use with the Infinite Financial Principle for over 16 years, however we additionally have and utilize the very same sort of plans directly.

Regardless obtaining a consultation can be vital. Our household's company, McFie Insurance, uses an independent insurance policy testimonial for free. Get in touch with us today if you want making certain your policy is properly designed and benefiting you in the right methods. Whole Life insurance is still the premier monetary asset.

What is the long-term impact of Private Banking Strategies on my financial plan?

I don't see that changing anytime quickly. Whether you have an interest in discovering even more about unlimited banking life insurance policy or aiming to begin making use of the principle with your very own policy, contact us to set up a cost-free method session. There's a great deal of confusion around finance; there's a lot to know and it's annoying when you don't recognize sufficient to make the ideal financial decisions.

What is Infinite Financial and exactly how does it function? Who is Infinite Financial for? If you're attempting to comprehend if Infinite Financial is best for you, this is what you require to recognize.

Too numerous individuals, himself included, got into financial trouble due to reliance on financial establishments. In order for Infinite Financial to function, you need your own financial institution.

What are the common mistakes people make with Infinite Banking Concept?

The major distinction between the 2 is that getting involved whole life insurance policy policies allow you to get involved or receive rewards based on revenues of the insurance policy business. With non-participating policies you do not get involved or receive returns from the insurance policy business.

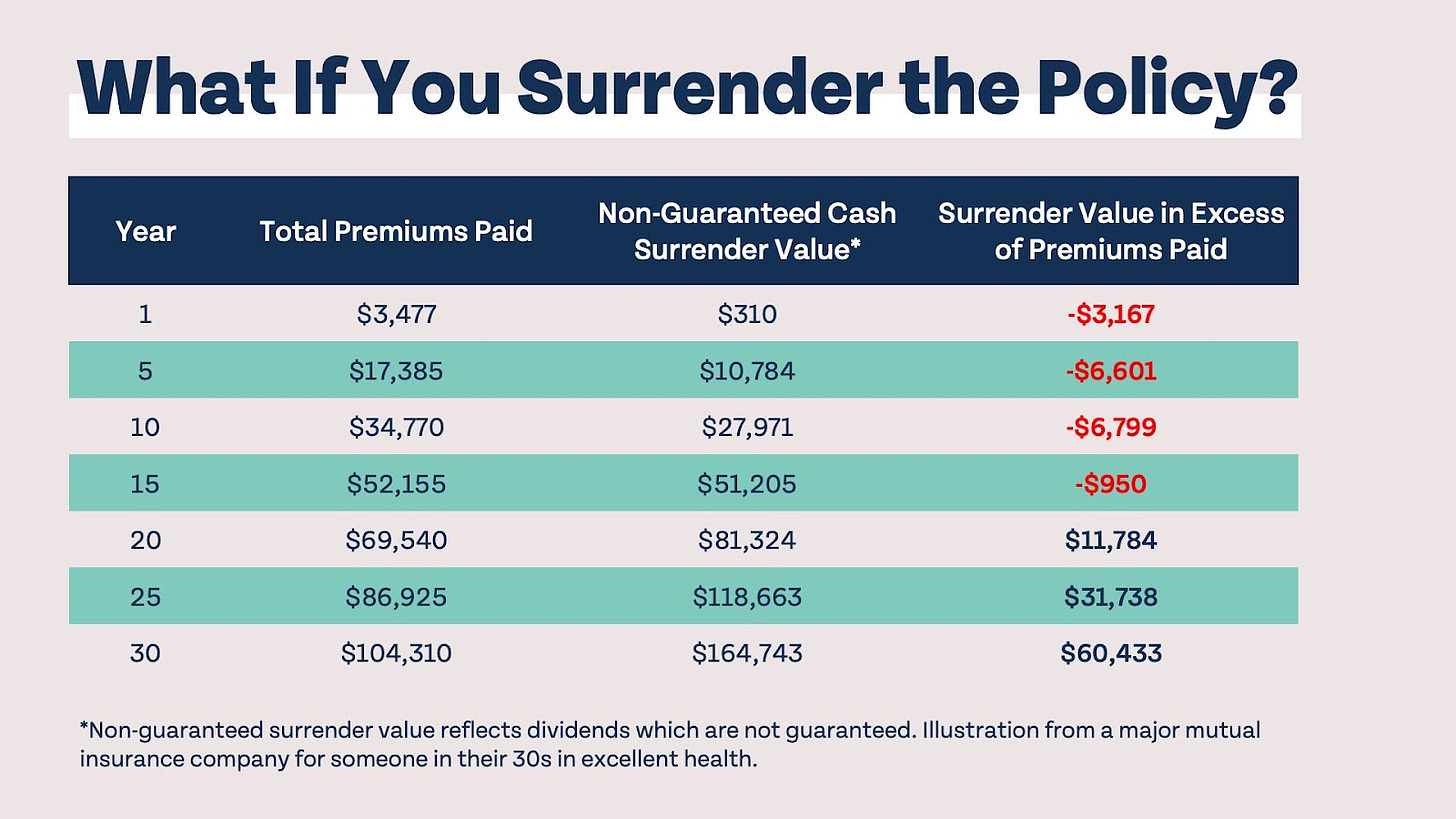

In addition, policy fundings are tax-free. Fairly, if you withdraw your cash money worth, any kind of quantity over your basisthe amount you've contributed in insurance premiumswill be taxed.

Dividend-paying whole life insurance policy is very low risk and supplies you, the insurance policy holder, a lot of control. The control that Infinite Banking uses can best be organized right into two classifications: tax advantages and asset defenses. Among the reasons whole life insurance is optimal for Infinite Banking is exactly how it's strained.

Latest Posts

How To Make Your Own Bank

Infinite Banking Concept Updated For 2025

Whole Life Insurance Bank On Yourself